Australian Alternative Energy Forum

Not Really a Forum, more of my memory aid.

Comments on this forum should never be taken as investment advice.

|

|||||||

|

|

|

Thread Tools | Display Modes |

|

#1

|

|||

|

|||

|

Our emphasis

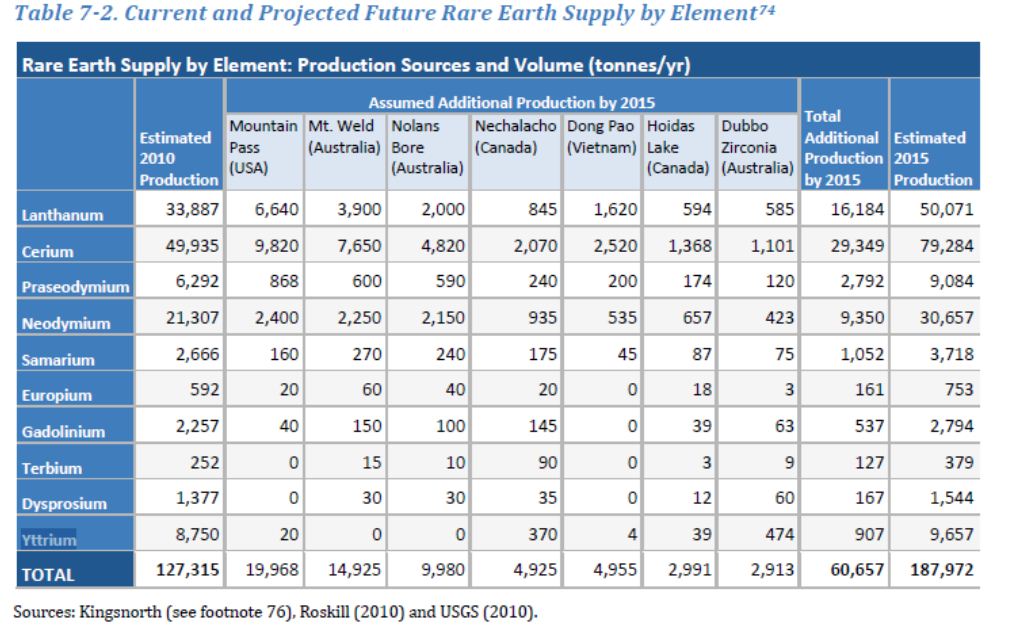

China Growth Plans & Supply of Neodymium & Dysprosium Chinese domestic demand growth for the rare-earth-permanent-magnet (REPM) metals neodymium (Nd) and dysprosium (Dy) over the next five years, will be strongly influenced and perhaps determined by, the emphasis on industrial policy announced in the new Chinese economic development Five-Year Plan. The general outline of this 12th Plan is reviewed and analyzed in the London Telegraph for March 5, 2011, in an article which is entitled ?China?s five-year plan: key points?. Before we discuss the specific section of the new Five-Year Plan that influences rare-earth-metals demand growth, we first need to understand that China?s industrial economy is centrally planned and rigorously controlled in detail, by the China State Council. This is the executive body of the Chinese Communist Party, which operates in a ?King-in-Council? manner similar to the way in which the British government operated when its monarch had actual power centuries ago. In the case of the China State Council, of course, it is the ?President? of China who is the head of state while the Prime Minister and State Council members are the daily overseers and rulers of the operations of the government. It?s not appropriate to refer to the China State Council as equivalent to the Chinese President?s cabinet as many pundits do. The State Council is much more than an advisory group to the President; it is actually operating as the office of the executive branch of the government, and it consists of powerful men, all members of the Communist Party hierarchy, the men who actually rule China. The China State Council does not recommend industrial policy; it defines, organizes, and controls the Chinese economy in order to achieve the goals of the Chinese industrial policy. The Council sets the goals ahead of time for each five-year period, and it has traditionally done so by asking the permanent civil-service bureaucracy to prepare position papers on their needs and wants, prior to the finalizing of each new plan. From these studies the China State Council decides on what the goals of the plan will be, and how the state?s total resources will be allocated to implement it successfully. The punditry usually refers to the Chinese planning as industrial policy, but it is as much direction as it is just simple policy. The Telegraph article contains the following in its translation of the Five-Year Plan?s key points: ?Introduce targets for energy efficiency and consumption that will see China finding 20pc of its energy from non-fossil fuel sources by 2015. The contribution of coal and oil to fall from its current 90pc to 80pc.? When I was in Beijing in August 2010, for the 6th Annual Chinese Society of Rare Earths Summit, a speaker representing the Chinese wind-turbine electricity-generation industry told the conference that in the next two Five-Year Plans (the 12th and 13th) beginning in 2011 China, in order to reduce the usage of coal to generate electricity and to improve energy-use efficiency per productive unit of capacity, would add 330 gigawatts of wind-generated electrical power, and that this would require a total of 59,000 metric tons of neodymium. He said that the wind turbines to be built would use REPM-type generators to save on weight and maintenance. The reaction of the crowd, overwhelmingly made up of Chinese rare-earth miners and refiners, seemed to be one mostly of surprise. I understood why this was so. The Nd required makes up just 28% of the total typical neodymium-iron-boron (Nd-Fe-B) alloy that comprises a REPM. Yet the spokesman from the Chinese wind-turbine industry had clearly said, and his slide showed, a need for 59,000 tonnes of new, additional, Nd demand that had not before been added to the demand-growth figures anyone had seen. The Chinese businessman next to me had been busy photographing the wind-industry spokesman?s slides. I asked why he didn?t just request a copy of the presentation. His reply was ?You?ll never get a copy from these guys. They?re running trial balloons for the State Council.? Nd is typically around 20% of the total REEs produced by the Chinese light-rare-earth industry. That total last year, 2010, has been said by Dr. Chen of the China Society for Rare Earths to have been just 89,000 tonnes of which 77,000 tonnes, or 86%, were light rare earths. This means that the Chinese production of Nd for 2010 was about 15,000 tonnes. Of the 12,000 tonnes of heavy rare earths produced in China in 2010, just 7% was reported to be the heavy rare earth Dy, which would mean that 840 tonnes of Dy were produced from the so-called ionic absorption clays in southern China. A typical Nd-Fe-B-based REPM contains 3-12% of Dy overall ? this means that 100 kg of such magnet alloy contains from 3 to 12 kg of Dy as well as around 28 kg of Nd. The OEM automotive industry uses the most Dy loading, as high as 12%, to give their REPM-based motors, sensors, generators and the like, the maximum service life at constant high-temperature use. Even assuming that the new demand for Nd-Fe-B-based alloy for the Chinese wind-turbine industry uses only 3% of Dy, and even if the 59,000 tonnes of Nd were only 59,000 tonnes in total of magnets, one would still need an additional 1,800 tonnes of Dy just for this project, as well as an additional 18,000 tonnes of Nd. If the demand for new additional Nd for the wind-turbine project is indeed 59,000 tonnes then a minimum demand for Dy could be 6,000 tonnes, which would be, at current production, the total dysprosium produced for the next 7 1/2 years! These demand-growth figures, assuming that the need is 59,000 tonnes of Nd, would require at least a doubling of current Chinese light-rare-earth-metal production and the total dedication of Dy production to this clean-tech goal for most of the next decade. If there is a further demand growth from the automobile industry, the current largest user of Dy-enhanced Nd-Fe-B-type REPMs, and that growth parallels the increase in motor-vehicle production expected in the next decade then this use alone will add the need for an additional production equal to the entire 2010 production of Nd and Dy. We would then be looking at a minimum at a torrid 15% a year growth in the demand for Nd and Dy between 2011 and 2020, just from the Chinese domestic-wind-turbine industry, and the global OEM automotive industry. Such growth may be possible for Nd production; it is unlikely to be achieved for Dy unless there is for the first time development of Dy resources outside of China. The Chinese have emphasized over the last year that they believe their Dy resources are being exhausted, and that at current rates of production they have only 5-25 years of production remaining. If the growth of demand for Nd and Dy above are correct, then it is most likely that Dy will be or is already in short supply. Therefore unless rare-earth mining ventures with commercially significant Dy are now brought into production as soon as possible, then clean-tech growth outside of China will slow down or stop, depending on whether or not the clean-tech manufacturer has a Chinese source for Nd-Fe-B-based-magnet-containing components, and that Chinese source has an export license for rare-earth-containing components. Jack Lifton is a leading authority on the sourcing and end use trends of rare and strategic metals. He is a founding principal of Technology Metals Research LLCand president of Jack Lifton LLC, consulting for institutional investors doing due diligence on metal-related opportunities. The following slide shows where we can expect this supply shortfall to come from if all goes well. Note that Australia's LYC, and ARU are well placed re Nd and ALK for Dy.  Read about Australian rare earths Reproduced with permission from Jack Lifton

Disclaimer: The author of this post, may or may not be a shareholder of any of the companies mentioned in this column. No company mentioned has sponsored or paid for this content. Comments on this forum should never be taken as investment advice. |

|

«

Previous Thread

|

Next Thread

»

|

|

All times are GMT. The time now is 08:27 PM.

Linear Mode

Linear Mode